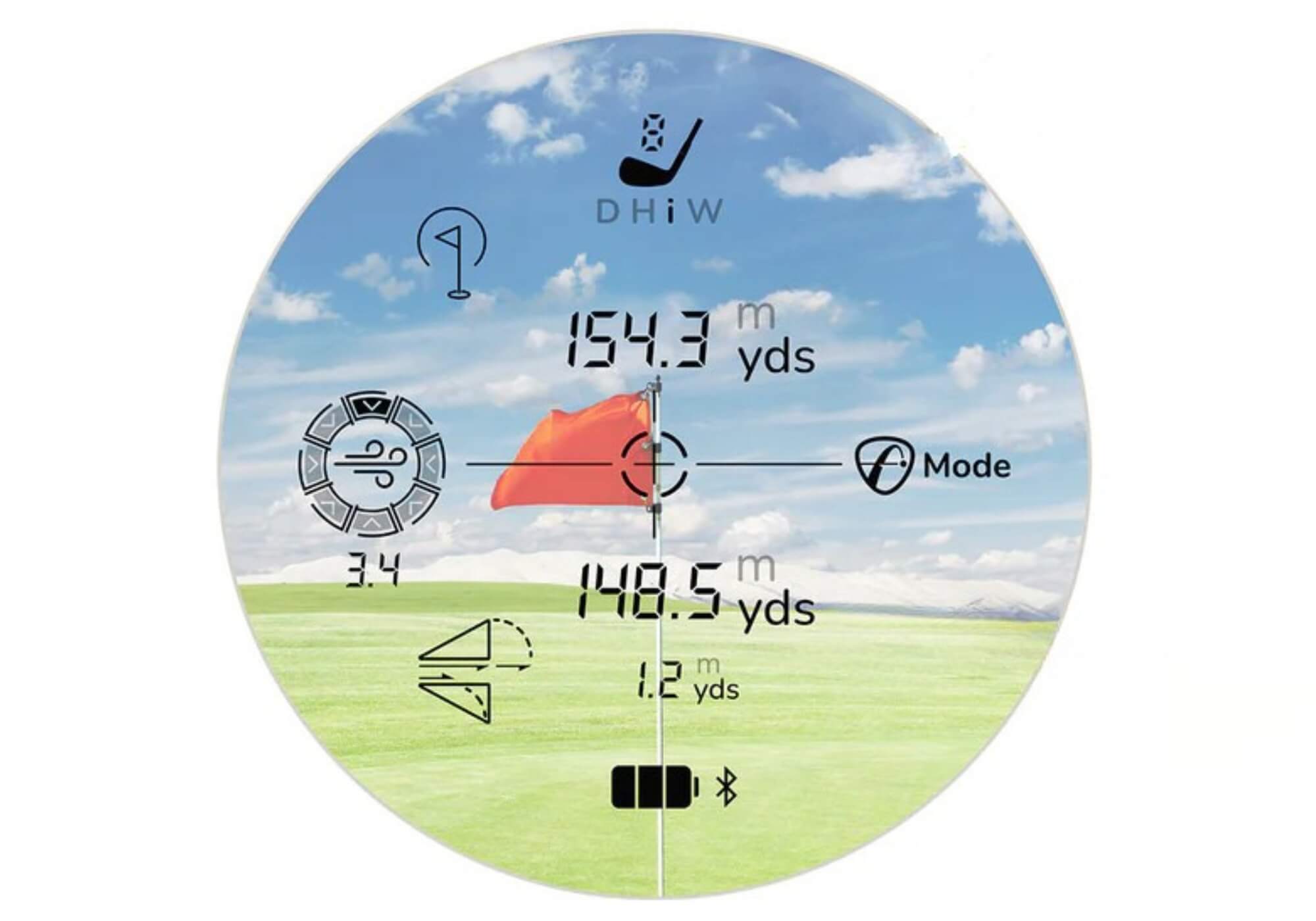

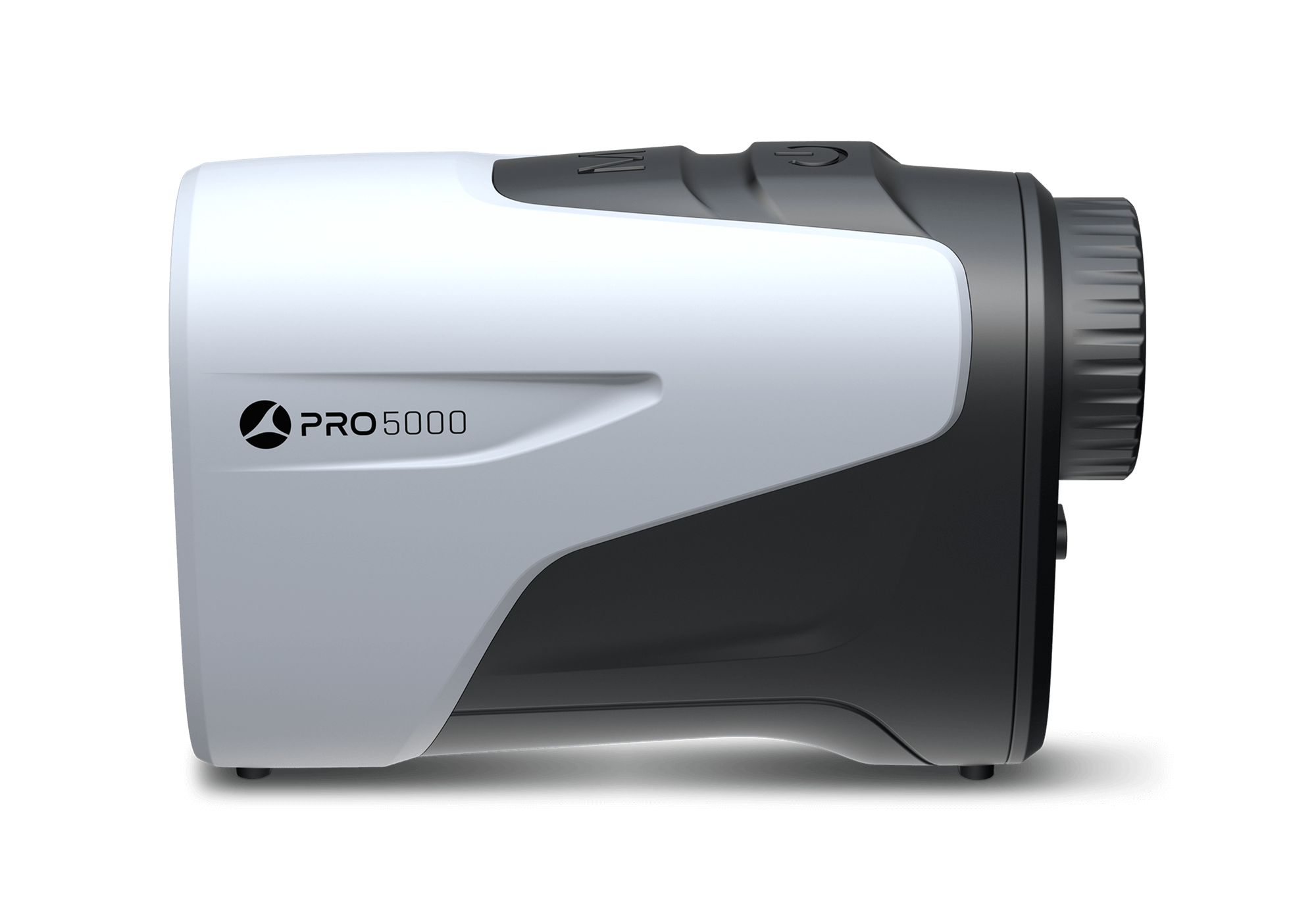

I got an email last week from Motocaddy announcing its new laser rangefinder, the PRO 5000. It sounds like a perfectly good rangefinder: an OLED display, the all-important slope function and a rechargeable battery. And the $249 price tag is pretty sweet.

When I suggested an article about it, my editor’s comment was: “Do we really need yet another $249 rangefinder?”

Sorry, boss, but that’s the wrong question. You should have asked, “Why would Motocaddy, or anyone else for that matter, launch anything that’s essentially a ‘me-too’ product?”

Turns out, there are plenty of reasons.

In the manufacturing world, this “me-too” concept goes by a different two-word name. It’s called “buy-sell.” You buy it from the people who make it, put your name on it and then sell it under your umbrella.

Motocaddy designs and sells some of the finest electric caddies on the planet. With this new rangefinder, Motocaddy is likely following a different script. Once the company decided to add a rangefinder to its portfolio, it sourced one from an Asian manufacturer.

After customizing the features, look and branding, presto, Motocaddy is in the rangefinder business.

Name an industry, any industry, and you’ll find buy-sell products. While the benefits to OEMs are considerable (which we’ll discuss), there’s plenty of upside for the consumer, albeit with an unintended consequence or two.

Why OEMs do this

“Me-too” is a classic follower strategy. It’s a low-risk way to tap into an attractive market that might be outside of your core competency. With minimal investment, you can offer a product with similar features, brand-based differentiation and attractive pricing.

Innovation is expensive. In the rangefinder world, a Garmin or a Bushnell with all the latest tech will carry the highest prices. Me-too products will have minimal new technology and will generally occupy the lower half of the market in terms of pricing.

Conversely, the buy-sell model will also have a lower margin. Since there’s minimal R&D and overall investment, whatever an OEM makes on that product will be gravy, anyway.

That’s really why an OEM would go this route. It’s a low-cost, low-risk effort to capture a sliver of a lucrative market. Market pioneers have already educated the market, created demand and done all the heavy lifting. They have, in a sense, created the market and established brand equity.

The me-too OEM, as a follower, gets to take advantage of the pioneer’s hard work and ride the wave without paying upfront innovation and market development costs. It’s easy market penetration and adds to both your top and bottom lines with minimal risk and investment.

Plenty of other benefits

When shopping online, have you ever added an item or two to your order just to reach the free-shipping threshold? The same thing happens in business. An OEM will add some me-too products to its offerings as potential add-ons so brick-and-mortar retailers can reach free-freight levels or even better volume-based discounts.

The OEM’s idea is, “Hey, they’re buying this stuff anyway so why not buy some of it from us?” The retailer’s idea is, “Hey, we’re selling this stuff anyway so why not get the best deal we can?”

For the retailer, an item such as a rangefinder represents nothing more than a product in a box. Clubs aside, the retailer’s job is to sell a box. In the big picture, it doesn’t matter much what’s in the box, as long as the quality matches the asking price. If they can make a few more bucks selling the add-on box, that’s a win.

The me-too model has other advantages. Even though the product may be a me-too, an OEM can leverage its own brand strength and branding while adding small functional improvements to differentiate the product. Additionally, in a fast-moving market segment like golf technology, an OEM can jump into the fray quickly. That allows them to capitalize on a trend while avoiding being labeled as “outdated.”

Are there downsides?

Of course there are. There are always downsides.

While me-too products give OEMs easy access to markets they have been missing, they can’t expect to sell at premium prices. That means they also can’t expect to extract premium margins. As a market gets flooded with me-too products in a single category, consumers can get overwhelmed with choices. At that point, the easy way out for consumers is to consider that product category a commodity, where there’s no measurable or appreciable difference. If the consumer is unable or unwilling to differentiate, price becomes the deciding factor. Granted, there might not be much of a difference other than price but once a market views a product as a commodity, margins for the OEM can erode further.

With me-too products, OEMs are acting as the ultimate middleman (you can make an argument that direct-to-consumer brands are nothing but middlemen but that’s a topic for another day). For an OEM that wants to portray itself as a leader or an innovator in other product categories, adding too many me-too products can be harmful to its brand.

Another downside is potential market saturation, which leads to comments like my editor asking if we really need another $249 rangefinder. In a saturated market, differentiation is more difficult and, potentially, more expensive. That can eat into those slim profit margins even more.

Are there benefits for the consumer?

To answer my boss’s question directly, once you have one $249 rangefinder on the market, you really don’t need a second one. Need, however, isn’t the deciding factor. Brands like broad product offerings because, as we mentioned, if a customer is going to buy something, it might as well come from us.

Provided, of course, we make a buck on it.

Ultimately, competition is good for consumers. First-to-market innovators have to cover development costs in their pricing. However, once those costs are covered and you’re no longer the only game in town, the me-too crowd swarms like a school of piranha, which benefits the consumer in two ways.

First, it offers lower-priced alternatives for said product. Second, and less obviously, it prompts those first-to-market innovators to innovate something new. It could be new technology, new features, new sizing or new styling. Adding something meaningful to the category reestablishes that brand as a leader and creates a new, higher-priced (with higher margins) model.

If you ever wondered why OEMs keep coming out with new products, that’s why.

And if you want a case study on the above concept, keep an eye on what happens with the Mileseey GenePro G1 rangefinder, which features a built-in GPS screen and other slick capabilities. When it was released this year, it sold for $499. You can buy one now for $399.

We’ll be anxious to see what Mileseey comes up with for 2026, not to mention when the me-too versions might hit the market.

There’s a downside for consumers, too

While choices are great, too many choices can be overwhelming. In her book, Cheap: The High Cost of Discount Culture, Boston University professor Ellen Ruppel Shell says too many options, including many of low quality, make it harder for consumers to evaluate what’s actually worth buying.

That leads to what’s known as the “paradox of choice.” Consumers can get what they want (a low price), without getting what they actually need (a good quality product that will last). Ultimately, consumers can be consumed by a form of cognitive dissonance where they’ll rationalize a poor choice, aggressively dispute negative reviews or dismiss differences and innovations as “marketing nonsense.”

Ultimately, too many choices can be paralyzing which leads to price-based decisions. If the price-based decision turns sour, the consumer will need to replace that product with something else. Another round of bad decisions leads to a culture of disposability and, even worse, misplaced cynicism.

Epilogue

Of course, none of this has anything to do with the new Motocaddy PRO 5000 rangefinder and whether it’s any good. Based on what we know about Motocaddy, there’s no doubt the PRO 5000 will work like a champ and represent an excellent value at $249. Motocaddy has worked hard to develop and protect its brand image, so you can safely presume the company did its homework before putting its name on the PRO 5000.

Therefore, you can add it to the growing list of laser rangefinders in the $249 price range that will serve you well. Of course, you can find rangefinders for less, sometimes a lot less, on Amazon or through other channels.

However, as the old saying goes: You pays your money, you take your chances.

The post Why Do Golf Companies Release “Me-Too” Products? appeared first on MyGolfSpy.